Date Published: 23 March 2020

Authors: Pradeep Kumar Singh, Bill Jamieson, Wong Pei-Ling and Marvin Chua.

(a) Payment

Under the EA, an employee must be paid at least once a month. In general, an employer is required to pay his employees within seven days after the end of the salary period.

Salary must be paid on a working day and during working hours at the place of work, or at any other place agreed to between the employer and the employee. It may also be paid into an employee’s personal/joint bank account.

(b) Payslips

All employers are required to issue itemised payslips to employees covered under the EA at least once a month. A record of all payslips issued must be kept by the employers for at least 2 years.

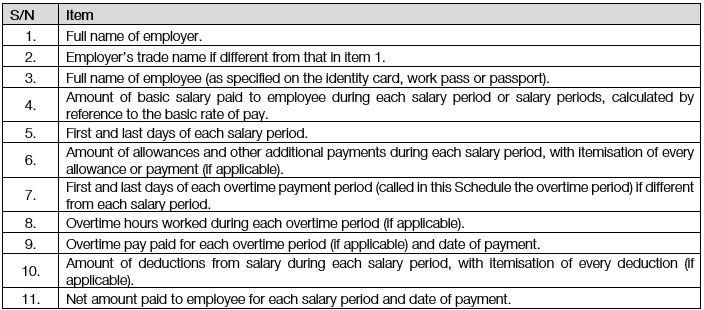

Itemised payslips can be in soft or hardcopy, and have no prescribed format, but must contain the following items[4] (unless not applicable):

(c) Deductions

Previously, employers may deduct salary only for reasons authorised under the EA or if ordered by the court. Since 1 April 2019, deductions are also allowed if made with the employee’s consent in writing to the deduction, and such consent may be withdrawn by the employee at any time without penalty.

Authorised deductions under the EA include deductions for absence from work, income tax payment and CPF contributions. The new amendments seek to provide more flexibility while safeguarding employees’ interests. An example where such deductions may occur includes a situation where employers may negotiate affordable group insurance plans as part of company employee benefits for voluntary purchase by their employees. Employees who choose to purchase such insurance plans may authorise their employer to deduct premiums from their salaries.

The maximum deductible amount in any one salary period is 50% of the employee’s total salary. This excludes deductions for absence from work, payment of income tax, recovery of loans and payments made with the consent of the employee. Within the 50% cap, deductions for accommodation, amenities and services may not exceed 25% of the employee’s total salary. The Commissioner’s approval is also required for any deductions for amenities and services supplied by the employer.

(d) Non-compliance

A first-time offence by any employer in failing to pay salary will result in a fine of between S$3,000 and S$15,000 and/or 6 months’ imprisonment. A subsequent offence will result in a fine of between S$6,000 and S$30,000 and/or 12 months’ imprisonment.

Failure to comply with the EA requirements for itemised payslips would be a civil contravention, attracting administrative penalties[5] of a fine of S$100 to S$200 for the first occurrence, and S$200 to S$400 for subsequent occurrences depending on the breach, and/or directions from MOM to rectify the civil contravention. A failure to comply with such directions will constitute a criminal offence, which attracts more severe penalties of fines up to S$5,000 and/or imprisonment of up to 6 months.

Under the EA, individual officers and directors are accountable for the offences committed by the company. In particular, officers who are primarily responsible for the non-compliance will be presumed to be negligent and held accountable unless proven otherwise.

Employment inspectors have the power to arrest, without warrant, any person whom they reasonably believe is guilty of the failure to pay salary, and to enter any workplace to conduct checks. The MOM has clarified that the powers of inspecting officers are to better facilitate the enforcement of the EA provisions, with the arrest powers only to be exercised in relation to the minority of employers who are persistently uncooperative or who wilfully refuse to comply with orders to attend investigation sessions.

Return to Employment Law Guide

Please note that this section of the Employment Law Guide is a summary provided for general information purposes, aimed at aiding understanding of Singapore’s employment law as at the date of writing. It is not exhaustive or comprehensive and reading this memorandum is not a substitute for reading the text of the various statutes to fully understand the extent of the obligations owed. This guide should also not be relied upon as legal advice.

GENERAL DISCLAIMER

This article is provided to you for general information and should not be relied upon as legal advice. The editor and the contributing authors do not guarantee the accuracy of the contents and expressly disclaim any and all liability to any person in respect of the consequences of anything done or permitted to be done or omitted to be done wholly or partly in reliance upon the whole or any part of the contents.