Date Published: 28 January 2020

Authors and Contributors: Jimmy Yap, Daphne Tan, and Lai Zheng Yong.

This article is the second in CNPUpdate’s new series on Indonesia Investment Updates, and aims to provide you with a general overview of the laws and regulations governing foreign investments into Indonesia.

How can I enter the Indonesian market?

Generally speaking, you can enter the Indonesian market by:

- establishing a general representative office (also known as a Kantor Perwakilan Perusahaan Asing, or “KPPA”); or

- incorporating a foreign investment limited liability company (Perseroan Terbatas Penanaman Modal Asing, or “PT PMA”).

There are other types of representative offices. For example, if you are in the construction industry, you may wish to consider establishing a foreign construction company representative office (also known as a Badan Usaha Jasa Konstruksi Asing or “BUJKA”), and if you are in the trade industry, a foreign trade representative office (also known as a Kantor Perwakilan Perdagangan Asing or “KP3A”). However, for the purposes of this article, we will only consider the KPPA.

Should I establish a KPPA or incorporate a PT PMA?

Whether you should establish a KPPA or incorporate a PT PMA depends on your objective. On the one hand, a KPPA is simply a representative office established by a company that has already been incorporated outside of Indonesia. A KPPA is not a separate legal entity, and cannot engage in commercial or revenue-generating activity or participate in the management of any company in Indonesia. Although it is possible for a KPPA to refer potential business transactions back to its foreign parent company, do remember to obtain tax advice as to whether, for example, withholding taxes may apply. Once you have received the relevant approvals, you will be granted a KPPA licence, which has an initial validity period of 3 years. You can apply to extend your KPPA licence twice, with each extension having a maximum period of 1 year.

A PT PMA, on the other hand, is a limited liability company. A PT PMA can sue and be sued in its own name, and own certain rights and assets. Unlike a KPPA, a PT PMA can engage directly in sales and revenue-generating activities provided that the necessary licences and permits have been obtained and exist in perpetuity. Note also that a PT PMA must have at least one director, one commissioner, and two shareholders (to whom an annual report must be presented) at any one time, and that foreign investment regulations may limit the extent of foreign ownership in the PT PMA.

How to establish a KPPA

Establishing a KPPA is relatively simple and can take between 30 to 40 business days. First, the foreign company must first appoint an individual as its chief representative in Indonesia. Whilst this individual can be an employee of the foreign company, they cannot be a director of the foreign company (though they can, for example, be a director of the foreign company’s subsidiary). There is presently no requirement for the chief representative to be an Indonesian citizen.

Second, and once the foreign company has appointed a chief representative, an application may be made to the Indonesia Investment Coordinating Board (Badan Koordinasi Penanaman Modal or “BKPM”). The application can be made by the foreign company, its chief representative, or any person authorised by the foreign company or chief representative to do so by way of a power of attorney. The application should be supported by, among other things:

- a Letter of Intent from the foreign company addressed to BKPM stating the foreign company’s intention to set up a representative office in Indonesia;

- a copy of the Letter of Appointment from the foreign company addressed to BKPM stating that the foreign company has appointed the individual named in the Letter of Appointment as the foreign company’s chief representative in Indonesia; and

- a Letter of Statement from the chief representative stating their willingness to stay and work only as the chief representative, without engaging in any other form of business in Indonesia.

Third, and once BKPM has approved the foreign company’s application by providing the foreign company with a Letter of Approval, the foreign company can proceed to apply to the Tax Registry for a Tax ID Number.

The KPPA will have been duly established once these documents have been obtained. Thereafter, the KPPA can proceed to sponsor applications for the relevant work and residence permits (respectively, Izin Mempekerjakan Tenaga Kerja Asing or “IMTA”; and Kartu Izin Tinggal Terbatas or “KITAS”) for expatriates.

How to incorporate a PT PMA

The process of incorporating an operationally-ready PT PMA involves several steps and applications to various authorities.

The first step is to conduct a name search and reserve the PT PMA’s name with Ministry of Law and Human Rights (“MOLHR”, which performs the functions of the registrar of companies), and prepare and sign a Deed of Establishment (also known as the Akta Pendirian Perseoran Terbatas). The Deed of Establishment is then signed by the founding shareholders of the PT PMA or their duly appointed attorneys in Indonesia before an Indonesian notary.[1] The Deed of Establishment must, among other things:

- contain the Articles of Association of the PT PMA (Anggaran Dasar);

- state the members of the PT PMA’s board of directors and commissioners; and

- state the authorised, paid-up, and issued share capital of the PT PMA.

The second step is to obtain MOLHR’s approval and ratification of the incorporation of the PT PMA. The Indonesian notary before whom the Deed of Establishment was signed will, after signing, lodge the signed Deed of Establishment with the MOLHR for the MOLHR’s review, approval, and ratification. Once the Deed of Establishment has been reviewed and approved by the MOLHR, MOLHR will issue the PT PMA with a letter stating that MOLHR has ratified the incorporation of the PT PMA. Only then is the PT PMA considered to have been validly incorporated. A shareholder’s resolution can thereafter be passed to amend the Articles of Association to conform with and/or incorporate the relevant terms of any joint venture or shareholders’ agreement.[2]

Once incorporated, the PT PMA must hold its first extraordinary general meeting (“EGM”) within sixty (60) days. At this EGM, the shareholders of the company should ratify all acts of the promoters in relation to the abovementioned granting of powers of attorney, thereby verifying the legitimacy of the PT PMA as a legal entity. The first annual general meeting is to be held within six (6) months of the end of the PT PMA’s financial year.

The third step comprises applications for several mandatory documents, licences, and approvals that must be completed to enable the PT PMA to commence operations. This includes applying for, for example and among other things:

- a tax identity number (Nomor Pokok Wajib Pajak or “NPWP”) and tax registration certificate (Surat Keterangan Terdaftar or “SKT”);

- apply for a business identification number (Nomor Induk Berusaha or “NIB”) [3] through the Online Single Submission (“OSS”) system;

- apply for a social security certificate (Badan Penyelenggara Jaminan Sosial Ketenagakerjaan or “BPJS”) and a mandatory manpower report (Wajib Lapor);

- where the PT PMA intends to employ expatriates, an IMTA and KITAS for each expatriate; and

- the relevant general and technical licences that the PT PMA is required by Indonesian laws and regulations to hold, before having their business licence (Izin Usaha) activated on the OSS and starting commercial operations in the respective lines of business.[4]

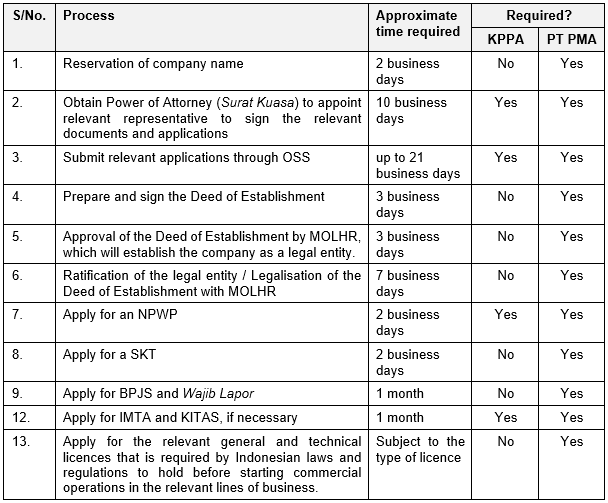

The following table summarizes the different steps in brief:

GENERAL DISCLAIMER

This article is provided to you for general information and should not be relied upon as legal advice. The editor and the contributing authors do not guarantee the accuracy of the contents and expressly disclaim any and all liability to any person in respect of the consequences of anything done or permitted to be done or omitted to be done wholly or partly in reliance upon the whole or any part of the contents.

Footnotes

[1] Do note that the Deed of Establishment should be signed in Indonesia. Further, where a founding shareholder (or their representative) is a foreigner and intends to travel to Indonesia to sign the Deed of Establishment, the proper visa (for example, a single- or multiple-entry business visa) should be obtained, as it is not appropriate to travel to Indonesia on a tourist visa for business purposes.

[2] On a practical note, in the interests of time and to facilitate the swift review, approval, and ratification of the Deed of Establishment by the MOLHR, a Deed of Establishment containing a simple and standard form Articles of Association is typically used.

[3] NIB serves also as the company registration certificate (Tanda Daftar Perusahaan), importer identification number (Angka Pengenal Impor), and customs access (Akses Kepabeanan).

[4] Examples of licences include, Location Permit (Izin Lokasi), Environmental Permit (Izin Lingkungan), and Building Construction Permit (Izin Mendirikan Bangunan).