Authors: Pradeep Kumar Singh, Bill Jamieson, Wong Pei-Ling and Marvin Chua.

(a) Current contribution rates

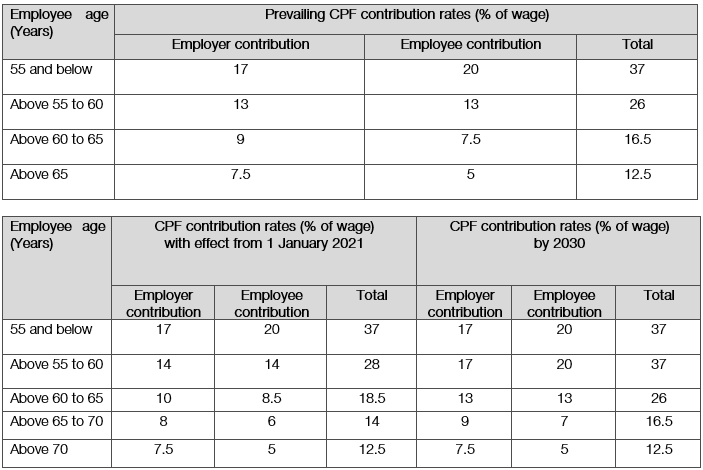

If the employee is a Singapore citizen or a Singapore permanent resident, contributions by both the employer and the employee will need to be made to the CPF. The present rates are 20% of the ordinary wages (up to a maximum of S$6,000 per month) from the employee and 17% of the ordinary wages (up to a maximum of S$6,000 per month) from the employer for employees who are up to 55 years of age and who are Singapore citizens or Singapore permanent residents who have been Singapore permanent residents for at least 3 years.

The contributions for Singapore permanent residents during the first two years of being Singapore permanent residents are at graduated rates to help them adjust to the lower take-home pay. The contribution rates reduce on a graduated scale for employees who exceed 55 years of age. Ordinary wages are generally the wages paid monthly, the wages due or granted wholly and exclusively in respect of an employee’s employment in that month. Contributions at the above rates also need to be made in relation to additional wages, for example, annual bonus which is not granted wholly and exclusively for the month but at intervals of more than one month and may, for example, be paid yearly. However, the maximum amount of wages including ordinary and additional wages on which contributions need to be made to CPF is S$102,000 which is equivalent to 17 months multiplied by the monthly CPF salary ceiling of S$6,000 which applies to all age groups. The current CPF Annual Limit (which is the maximum amount of mandatory and voluntary contributions to all three CPF Accounts that a CPF member can receive in a calendar year) is S$37,740.

(b) CPF contribution rates from January 2021

The CPF contribution rates for Singapore citizens and Singapore permanent residents aged 55 to 70 will be raised gradually with effect from 1 January 2021. By 2030, those aged 60 and below will enjoy full CPF rates (i.e. 20% of the ordinary wages (up to a maximum of S$6,000 per month) from the employee and 17% of the ordinary wages (up to a maximum of S$6,000 per month) from the employer).

The prevailing and new CPF contribution rates from 1 January 2021 (for employees with monthly wages exceeding S$750) is demonstrated below:

It is unclear how the CPF contribution rates of the employer’s and employee’s share of CPF contribution would each increase between 1 January 2021 and 2030. However, each subsequent increase should not exceed 1% and the total increase in the employer’s share will generally be lower than the employee’s share.

All CPF contributions payable by an employer for the month shall be paid no later than 14 days after the end of the month in respect of which contributions are payable.

(c) Related assistance measures for employers

The Special Employment Credit (“SEC”) was introduced in the 2011 budget and is extended up to 31 December 2020, to support employers, and to raise the employability of older low-wage Singaporeans. To promote voluntary re-employment of older workers, employers who hire Singaporean workers aged above 67 earning up to S$4,000 a month will receive an additional offset of up to 3% of wages. Taken together with the existing SEC incentives, employers who employ such older workers would get up to 11% in wage offset.

To support employment of Persons with Disabilities (PWDs), the SEC was extended to employers that hire Persons with Disabilities of all ages. The SEC for ’WDs aged between 13 and 65 is set at 16% of the employee’s monthly income, up to S$240 per month. The SEC for PWDs aged 65 and above is set at 22% of monthly income, up to S$330 per month.

(d) Penalties for non-payment/late payment of CPF

The fine for first time offenders is up to S$5,000, and a mandatory minimum fine of S$1,000 will be imposed for each charge and/or up to 6 months jail.

A fine of up to S$10,000 and no less than S$2,000 for each charge and/or 12 months jail may be imposed for repeat offenders.

Please note that this section of the Employment Law Guide is a summary provided for general information purposes, aimed at aiding understanding of Singapore’s employment law as at the date of writing. It is not exhaustive or comprehensive and reading this memorandum is not a substitute for reading the text of the various statutes to fully understand the extent of the obligations owed. This guide should also not be relied upon as legal advice.

Read The Other Sections of The Employment Law Guide

GENERAL DISCLAIMER

This article is provided to you for general information and should not be relied upon as legal advice. The editor and the contributing authors do not guarantee the accuracy of the contents and expressly disclaim any and all liability to any person in respect of the consequences of anything done or permitted to be done or omitted to be done wholly or partly in reliance upon the whole or any part of the contents.