Date Published: 28 August 2019

Authors: Bill Jamieson, Amit Dhume, Abel Ho and Neeti Relan.

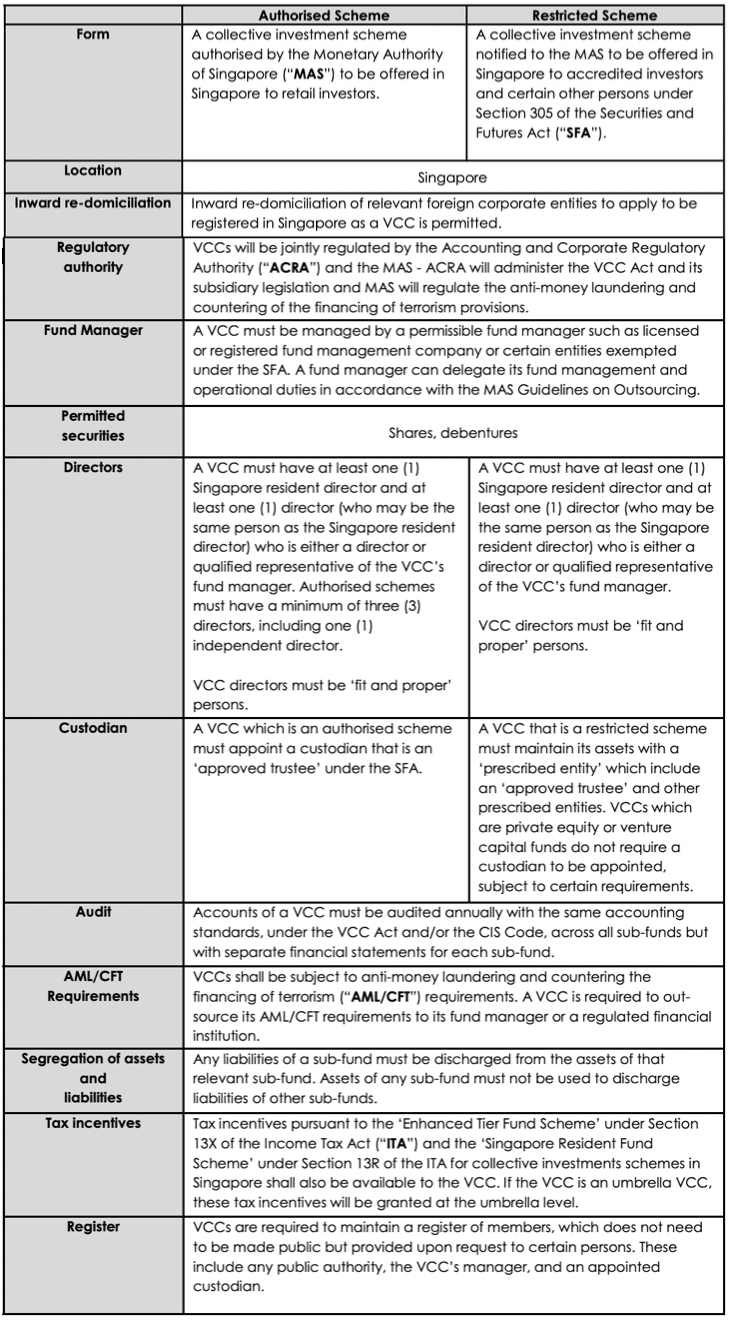

This table provides you with a useful overview of the Variable Capital Company (“VCC”). It highlights the unique characteristics of the VCC and key requirements under the VCC regulatory framework.

Use of the Variable Capital Company for types of funds in Singapore

A Variable Capital Company (“VCC”) is a corporate investment structure that can have underlying cells that may be a mix of open-ended and closed-ended sub-funds.

GENERAL DISCLAIMER

This article is provided to you for general information and should not be relied upon as legal advice. The editor and the contributing authors do not guarantee the accuracy of the contents and expressly disclaim any and all liability to any person in respect of the consequences of anything done or permitted to be done or omitted to be done wholly or partly in reliance upon the whole or any part of the contents.